Despite precious metals and gold / silver mining stocks going flat this year so far, the drilling sector performs quite nicely:

source: Simple Digressions

To remind my readers - the DRILL index comprises the shares of the following drilling companies: Energold Drilling, Major Drilling, Orbit Garant, Geodrill and Capital Drilling.

Note that the index can be considered as a leading indicator for the precious metals sector. For example, since March 2011 the DRILL index was under-performing against one of the most popular gold mining ETFs, GDX (the red arrow). For those that do not remember - gold made a top in middle 2011 and GDX topped in late 2011 but the DRILL index was at that time in its full-gear bear market phase.

Then, since the end of 2012 the index was flat against GDX, gold etc.(the violet rectangle) sending a message that not all things were that bad as many thought.

Now we have a very weak bull market in precious metals but the DRILL index is performing much better than GDX (the blue arrow). So, once again, the message is clear - the bull market in precious metals is still alive.

Thursday, November 30, 2017

Tuesday, November 28, 2017

Are We In A Bull Or A Bear Market In Precious Metals - Two Misleading Charts

Precious metals flows data, delivered by popular gold / silver ETFs, can be very misleading. For example, look at these two charts:

iShares Gold Trust (IAU)

source: Simple Digressions and the IAU data

The chart shows gold flows reported by IAU. The red line depicts cumulative flows calculated for the period January 1 - November 27, 2017. It is easy to spot that as many as 1.5 million ounces of gold have been added to IAU vaults this year so far.

Now look at this chart:

iShares Silver Trust (SLV)

source: Simple Digressions and the SLV data

SLV is the world's largest private holder of silver bullion. However, this year this giant recorded a cumulative outflow of 24.2 million ounces of silver.

Now the question is: are we in a bull market or a bear market in precious metals? Or maybe this question is badly-formulated?

iShares Gold Trust (IAU)

source: Simple Digressions and the IAU data

The chart shows gold flows reported by IAU. The red line depicts cumulative flows calculated for the period January 1 - November 27, 2017. It is easy to spot that as many as 1.5 million ounces of gold have been added to IAU vaults this year so far.

Now look at this chart:

iShares Silver Trust (SLV)

source: Simple Digressions and the SLV data

SLV is the world's largest private holder of silver bullion. However, this year this giant recorded a cumulative outflow of 24.2 million ounces of silver.

Now the question is: are we in a bull market or a bear market in precious metals? Or maybe this question is badly-formulated?

Monday, November 27, 2017

To Subscribers To The 2017 Top Five Portfolio

The fifth update to the 2017 Top Five Portfolio was dispatched today (November 27).

If your email box is empty - please, let me know (I will send it again).

If your email box is empty - please, let me know (I will send it again).

Friday, November 24, 2017

To Subscribers To The Top Five Portfolio

Next week (Monday or Wednesday) you will receive a final report on the Top Five Portfolio.

Thursday, November 23, 2017

Silvercorp Announces Another Share Buy-Back

Today Silvercorp Metals announced that it wanted to acquire up to 8.4 million shares. So, once again, the company is announcing a share buy-back program.

To remind my readers, Silvercorp announced three such programs: in 2014, 2015 and now. The first two programs were very ambitious - the company wanted to repurchase around 16 million shares but until March 31, 2016 Silvercorp repurchased a mere 4.0 million shares. Since that time no single share was bought back.

Now they want to purchase "only" 8.4 million shares but...will they do it?

As a matter of fact - they have a lot of cash:

source: Simple Digressions

As the chart shows, at the end of 3Q 2017 the company had cash of $99M. Taking the current share price of $2.51, Silvercrop could repurchase as many as 39.4 million shares (in theory).

To remind my readers, Silvercorp announced three such programs: in 2014, 2015 and now. The first two programs were very ambitious - the company wanted to repurchase around 16 million shares but until March 31, 2016 Silvercorp repurchased a mere 4.0 million shares. Since that time no single share was bought back.

Now they want to purchase "only" 8.4 million shares but...will they do it?

As a matter of fact - they have a lot of cash:

source: Simple Digressions

As the chart shows, at the end of 3Q 2017 the company had cash of $99M. Taking the current share price of $2.51, Silvercrop could repurchase as many as 39.4 million shares (in theory).

Wednesday, November 22, 2017

Energold Drilling - 3Q 2017 Results

Yesterday Energold Drilling released its 3Q 2017 report. Firstly, let me look at the drilling prices reported by two Energold's main divisions: Mineral and Energy:

source: Simple Digressions

The chart on the left shows mineral drilling prices. And it is easy to spot that in 3Q 2017 the prices went up but the increase was much less impressive than in the case of two other drillers I discussed earlier on this blog (Geodrill and Orbit Garant). I guess this slight increase may be explained easily - Energold offers its services at much higher prices than Geodrill and Orbit. Let me compare these prices (as of 3Q 2017):

So, Energold is expensive, compared to Orbit.

As a result, Orbit drilled 404 thousand metres in 3Q 2017 while Energold only 76 thousand metres. Or, using different metric, Orbit delivered a gross margin of C$4.7M while the Mineral Division of Energold delivered a $1.3M.

Let my readers arrive at their own conclusions which driller offers more efficient strategy...*

* I would be very cautious about formulating a final conclusion - it can be tricky

source: Simple Digressions

The chart on the left shows mineral drilling prices. And it is easy to spot that in 3Q 2017 the prices went up but the increase was much less impressive than in the case of two other drillers I discussed earlier on this blog (Geodrill and Orbit Garant). I guess this slight increase may be explained easily - Energold offers its services at much higher prices than Geodrill and Orbit. Let me compare these prices (as of 3Q 2017):

- Geodrill: CS$129 per meter

- Orbit: C$105 per meter

- Energold: C$153 per meter

So, Energold is expensive, compared to Orbit.

As a result, Orbit drilled 404 thousand metres in 3Q 2017 while Energold only 76 thousand metres. Or, using different metric, Orbit delivered a gross margin of C$4.7M while the Mineral Division of Energold delivered a $1.3M.

Let my readers arrive at their own conclusions which driller offers more efficient strategy...*

* I would be very cautious about formulating a final conclusion - it can be tricky

Tuesday, November 21, 2017

Impact Silver - Where Are Your Stockpiles?

After the decent year 2016, this year Impact Silver performs quite poorly. Look at the chart below:

source: Simple Digressions

Although the production level was generally stable, costs of production were a bit higher this year.

As a result, cash flow from operations (excluding working capital issues) was negative in 3Q 2017:

source: Simple Digressions

Interestingly, it looks like Impact feels very confident about the future. As of the end of September 2017 the company had no stockpiles (to be honest, at the end of 2016 there were also nearly no stockpiles) so any technical problem at one of the mines and...the production is stopped:

source: Impact Silver, 3Q 2017 report, page 9

source: Simple Digressions

Although the production level was generally stable, costs of production were a bit higher this year.

As a result, cash flow from operations (excluding working capital issues) was negative in 3Q 2017:

source: Simple Digressions

Interestingly, it looks like Impact feels very confident about the future. As of the end of September 2017 the company had no stockpiles (to be honest, at the end of 2016 there were also nearly no stockpiles) so any technical problem at one of the mines and...the production is stopped:

source: Impact Silver, 3Q 2017 report, page 9

Sunday, November 19, 2017

U.S. Dollar And Gold

Many people think that the US dollar and gold go in the opposite directions. Well, in many cases it is true but look at this chart:

source: Stockcharts.com

The chart shows that taking 2008 as a starting point (financial crisis of 2007 - 2008), both instruments (gold and dollar) are significantly up:

source: Stockcharts.com

The chart shows that taking 2008 as a starting point (financial crisis of 2007 - 2008), both instruments (gold and dollar) are significantly up:

- gold: 37.1%

- US dollar: 30.7%

Friday, November 17, 2017

Geodrill - Good Figures Once Again

Another drilling company, Geodrill (OTCMKTS:GDLLF), released very good 3Q 2017 figures. To remind my readers, Geodrill is a mineral drilling company operating in Western Africa only (Ghana, Burkina Faso etc.).

In 3Q 2017 the company, similarly to Orbit Garant, reported the highest drilling prices in its history:

source: Simple Digressions

As the middle panel of the chart below shows, direct costs of drilling also went up significantly (due to higher salaries) but...it did not matter. Much better pricing covered higher costs and a gross margin (defined as revenue less direct costs) was one of the highest in history as well:

source: Simple Digressions

Summarizing - another drilling company gives an evidence that the mineral sector (particularly its precious metals segment) does quite well now.

In 3Q 2017 the company, similarly to Orbit Garant, reported the highest drilling prices in its history:

source: Simple Digressions

As the middle panel of the chart below shows, direct costs of drilling also went up significantly (due to higher salaries) but...it did not matter. Much better pricing covered higher costs and a gross margin (defined as revenue less direct costs) was one of the highest in history as well:

source: Simple Digressions

Summarizing - another drilling company gives an evidence that the mineral sector (particularly its precious metals segment) does quite well now.

Tuesday, November 14, 2017

It Looks Like The Oil Is Topping Now

According to the latest Commitments of Traders report, Money Managers trading Crude Oil (light sweet) futures increased their net long position in these futures to 340.2 thousand contracts or 13.1% (calculated as the net long position divided by the total open interest):

In that way the LONG oil trade entered the over bullish area.

Note that each time there was excessive optimism among Money Managers (the area marked in light green) oil prices were topping.

It looks like the recent jump in oil prices was driven by the shorts cutting their bets in panic (for example during the week that ended on October 31):

Finally, last week the longs took control over the market (increasing their position by 24.0 thousand contracts) supported by the shorts still cutting their exposure (a cut of 18.3 thousand contracts).

In my opinion, a prudent trader / speculator should avoid the LONG trade in oil now...

In that way the LONG oil trade entered the over bullish area.

Note that each time there was excessive optimism among Money Managers (the area marked in light green) oil prices were topping.

It looks like the recent jump in oil prices was driven by the shorts cutting their bets in panic (for example during the week that ended on October 31):

Finally, last week the longs took control over the market (increasing their position by 24.0 thousand contracts) supported by the shorts still cutting their exposure (a cut of 18.3 thousand contracts).

In my opinion, a prudent trader / speculator should avoid the LONG trade in oil now...

Sunday, November 12, 2017

Orbit Garant - The Results Delivered By This Drilling Company Should Satisfy The Gold Bulls

It looks like the bear market in the mineral drilling sector is over. A few days ago Orbit Garant (OBGRF), a small mineral drilling company operating mainly in Canada (this country accounts for 75% of total revenue reported in 3Q 2017), released its 3Q 2017 report.

Look at this chart - in my opinion, it is one of the most important charts I published this year:

source: Simple Digressions

Note that the drilling prices reported in 3Q 2017 were the highest in history. Well, the company is, as always, very cautious about its future (and it should be) but the facts support a bullish thesis on the precious / base metals market - rising prices signal that the industry is definitely recovering.

Despite higher prices, Orbit is able to drill more and more metres:

source: Simple Digressions

Well, higher prices and more work to do result in an impressive jump in cash flow from operations (excluding working capital issues and taxes):

source: Simple Digressions

What is more, as of the end of September 2017 Orbit had the short-term debt of C$16.4M (which was a risk factor) but on November 2, 2017 it signed a new agreement with its lender (which de-risks the company). Let me cite the company (3Q 2017 FS, page 12):

"On November 2, 2017, the Company and the Lender entered into an amended and restated credit agreement that replaces the Credit Facility with a new three-year credit facility, consisting of a $30 million revolving credit facility, a US$3 million letter of credit facility and a US$3 million revolving credit facility"

Now the question is whether Orbit share prices are able to break out above the latest trading range (the red rectangle):

source: Stockcharts.com

Look at this chart - in my opinion, it is one of the most important charts I published this year:

source: Simple Digressions

Note that the drilling prices reported in 3Q 2017 were the highest in history. Well, the company is, as always, very cautious about its future (and it should be) but the facts support a bullish thesis on the precious / base metals market - rising prices signal that the industry is definitely recovering.

Despite higher prices, Orbit is able to drill more and more metres:

source: Simple Digressions

Well, higher prices and more work to do result in an impressive jump in cash flow from operations (excluding working capital issues and taxes):

source: Simple Digressions

What is more, as of the end of September 2017 Orbit had the short-term debt of C$16.4M (which was a risk factor) but on November 2, 2017 it signed a new agreement with its lender (which de-risks the company). Let me cite the company (3Q 2017 FS, page 12):

"On November 2, 2017, the Company and the Lender entered into an amended and restated credit agreement that replaces the Credit Facility with a new three-year credit facility, consisting of a $30 million revolving credit facility, a US$3 million letter of credit facility and a US$3 million revolving credit facility"

Now the question is whether Orbit share prices are able to break out above the latest trading range (the red rectangle):

source: Stockcharts.com

Saturday, November 11, 2017

Alio Gold - I Was Wrong

On November 9, 2017 Alio Gold (ALO) released its 3Q 2017 report. As expected, the company delivered the worst results this year but...they were not that bad as I predicted:

source: Simple Digressions

As you surely remember, I projected the 3Q 2017 gross margin of US$1.6M but the company reported a higher figure (US$7.7M).

What happened? Well, I had underestimated Alio - instead of the mining cost of US$3.2 per ton of ore processed, the company recorded the actual cost of US$2.6 per ton of ore.

In other words, I took the average cost of production reported during the latest four quarters but Alio was able to cut it even below the 2Q 2017 figure. So, hats off to the management and shame on me (I was too skeptical).

Unfortunately, the company has cut its 4Q 2017 production guidance from 20 - 22 thousand ounces of gold to 14.5 - 18.5 thousand ounces. The cut resulted in another selling wave:

source: Stockcharts.com

Very likely, the price drop has also something to do with Torex and its problems in the Guerrero State, Mexico.

To remind my readers, Alio is going to build its Ana Paula gold mine in the same, quite dangerous, state so problems at Torex the El Limon - Guajes mine may have a negative impact on Alio.

source: Simple Digressions

As you surely remember, I projected the 3Q 2017 gross margin of US$1.6M but the company reported a higher figure (US$7.7M).

What happened? Well, I had underestimated Alio - instead of the mining cost of US$3.2 per ton of ore processed, the company recorded the actual cost of US$2.6 per ton of ore.

In other words, I took the average cost of production reported during the latest four quarters but Alio was able to cut it even below the 2Q 2017 figure. So, hats off to the management and shame on me (I was too skeptical).

Unfortunately, the company has cut its 4Q 2017 production guidance from 20 - 22 thousand ounces of gold to 14.5 - 18.5 thousand ounces. The cut resulted in another selling wave:

source: Stockcharts.com

Very likely, the price drop has also something to do with Torex and its problems in the Guerrero State, Mexico.

To remind my readers, Alio is going to build its Ana Paula gold mine in the same, quite dangerous, state so problems at Torex the El Limon - Guajes mine may have a negative impact on Alio.

Tuesday, November 7, 2017

Jaguar Mining - Good 3Q 2017 Results

Today Jaguar Mining (JAGGF; JAG.TO) released its 3Q 2017 report. And, at last, these results were really good. Look at these two charts:

source: Simple Digressions

Firstly, cash flow from operations has been in a steady increase since 1Q 2017 (the red arrow on the left). Secondly, in 3Q 2017 the company was, for the first time since the end of 2016, able to deliver free cash flow (the panel on the right).

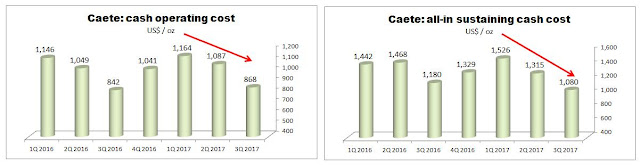

Interestingly, the main contributing factor standing behind these nice results was the Caete mining complex. Here are the charts showing the costs reported by the Caete complex (Pilar + Roca Grande):

source: Simple Digressions

I particularly like the all-in sustaining cash cost reported by Caete. Now this mining complex produces its gold at the cost of $1,080 per ounce, which is absolutely an outstanding result. Compare this operation to, say, 1Q 2017, when this cost was $1,526 per ounce and Caete was cash flow negative. Good managerial work...

And what about Turmalina, a former flagship property? Well, there is regress at this operation but..it is still quite a decent mine. Look at the all-in sustaining cash costs reported by Turmalina:

source: Simple Digressions

Although the costs are still rising, the current AISC of $1,002 per ounce of gold is not too elevated.

Anyway, most importantly, both operations are now free cash flow positive.

source: Simple Digressions

Firstly, cash flow from operations has been in a steady increase since 1Q 2017 (the red arrow on the left). Secondly, in 3Q 2017 the company was, for the first time since the end of 2016, able to deliver free cash flow (the panel on the right).

Interestingly, the main contributing factor standing behind these nice results was the Caete mining complex. Here are the charts showing the costs reported by the Caete complex (Pilar + Roca Grande):

source: Simple Digressions

I particularly like the all-in sustaining cash cost reported by Caete. Now this mining complex produces its gold at the cost of $1,080 per ounce, which is absolutely an outstanding result. Compare this operation to, say, 1Q 2017, when this cost was $1,526 per ounce and Caete was cash flow negative. Good managerial work...

And what about Turmalina, a former flagship property? Well, there is regress at this operation but..it is still quite a decent mine. Look at the all-in sustaining cash costs reported by Turmalina:

source: Simple Digressions

Although the costs are still rising, the current AISC of $1,002 per ounce of gold is not too elevated.

Anyway, most importantly, both operations are now free cash flow positive.

Friday, November 3, 2017

Tesla Motors - Did It Go Too Far?

Quite often financial crises start from a set of events. I have no idea what event is going to ignite another crisis (if there is any crisis) but Tesla Motors fits a crisis scenario very well. Look at these two charts:

The first chart shows Tesla's net debt (defined as debt less cash) and free cash flow (defined as cash flow from operations less investment spending):

source: Simple Digressions

Note: free cash flow reported during 3Q 2017 YTD is the sum of free cash flows reported in 1Q, 2Q and 3Q 2017

As the chart shows, the higher net debt the higher negative free cash flow, which is a nice recipe for severe financial problems.

The second chart shows cash flow from operations before working capital adjustments. In other words, it shows cash flow delivered by Tesla's core business:

source: Simple Digressions

Note that this year up to date the company has generated lower cash flow than in 2016. Of course, the fourth quarter may be totally different but during first three quarters of 2016 Tesla delivered cash flow of $471.6M, which was a slightly higher figure than that reported this year ($420M). So there is some regress anyway.

To be honest, I like Elon Musk. He is a visionary but as far as financial issues are concerned such a company as Tesla has to be led by a hardball financial officer. A quick look at Tesla's balance sheet makes me wondering whether there is any financial officer at all.

Summarizing - it looks like the whole world (banks, investors, Tesla's customers etc.) is financing the visions created by Elon Musk. However, the main questions is: Did Tesla go too far?

Last but not least - I am not going to start commenting on other issues than the precious metals market. Not at all. However, any financial crisis should have a positive impact on gold and silver. Simply put - during financial meltdowns the precious metals are safe harbors so Tesla's problems could have an indirect positive impact on gold and silver prices at some time in the future....

The first chart shows Tesla's net debt (defined as debt less cash) and free cash flow (defined as cash flow from operations less investment spending):

source: Simple Digressions

Note: free cash flow reported during 3Q 2017 YTD is the sum of free cash flows reported in 1Q, 2Q and 3Q 2017

As the chart shows, the higher net debt the higher negative free cash flow, which is a nice recipe for severe financial problems.

The second chart shows cash flow from operations before working capital adjustments. In other words, it shows cash flow delivered by Tesla's core business:

source: Simple Digressions

Note that this year up to date the company has generated lower cash flow than in 2016. Of course, the fourth quarter may be totally different but during first three quarters of 2016 Tesla delivered cash flow of $471.6M, which was a slightly higher figure than that reported this year ($420M). So there is some regress anyway.

To be honest, I like Elon Musk. He is a visionary but as far as financial issues are concerned such a company as Tesla has to be led by a hardball financial officer. A quick look at Tesla's balance sheet makes me wondering whether there is any financial officer at all.

Summarizing - it looks like the whole world (banks, investors, Tesla's customers etc.) is financing the visions created by Elon Musk. However, the main questions is: Did Tesla go too far?

Last but not least - I am not going to start commenting on other issues than the precious metals market. Not at all. However, any financial crisis should have a positive impact on gold and silver. Simply put - during financial meltdowns the precious metals are safe harbors so Tesla's problems could have an indirect positive impact on gold and silver prices at some time in the future....

Subscribe to:

Comments (Atom)