While JP Morgan accumulates silver, the Chinese do the opposite (or something different is happening):

source: Simple Digressions

Since the beginning of March the Shanghai Futures Exchange (SFE) has reported silver outflows. What is more, last week as many as 4.0 million ounces of silver were withdrawn from the SFE vaults (spot the red bar on the lower panel of the chart).

Now the question is: how to interpret these changes?

There are two possible answers:

- similarly to gold withdrawals, silver withdrawals are a sign of silver accumulation by the Chinese

- the withdrawals are an indication of the decreasing demand

Since April 17 each trading day silver prices have been going down. I realize that precious metals bugs are in despair. Yes, it is an awful market. The question is not whether gold or silver prices go down but how deeply they are going to drop.

However, JP Morgan does not care about it. Look at the chart below:

source: Simple Digressions

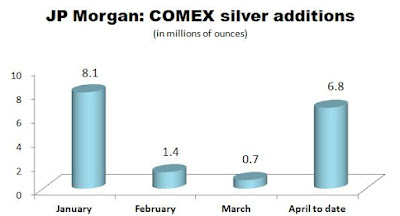

As the chart shows, each trading day the guys at JP Morgan are adding silver to the bank's vaults at the COMEX.

Interestingly, the accumulation of silver by JP Morgan has just entered its parabolic stage (red circle):

source: Simple Digressions

P.S. Today (April 28) they added another 915 thousand ounces (the chart has been updated)

Today Barrick Gold (ABX) released its 1Q 2017 report. In my opinion the results were decent however Barrick's shares are diving now (at the time of writing this post they are 9.8% down). What is going on? Well, the company also published its updated production outlook for this year. Look at the table below:

all figures in thousands of ounces

source: Simple Digressions

The table compares the current and initial outlook (I have plotted the average values). Here is my comment:

source: Simple Digressions

The table compares the current and initial outlook (I have plotted the average values). Here is my comment:

- firstly, according to the current outlook, the overall production is estimated to stand at 5,428 thousand ounces of gold

- it means a cut of 365 thousand ounces, compared to the initial outlook

- the biggest cut in production is attributable to the Veladero mine (345 thousand ounces of gold less than in the previous estimate)

- however, this cut is mainly due to the strategic agreement with the Chinese gold miner, Shandong. According to that agreement, starting from July 1, 2017 Veladero will be shared 50%:50% with this miner. Hence, the overall Veladero production is going to be lower by 200 thousand ounces, compared to the initial outlook

- unfortunately, due to the technical failure at Veladero, the mine is temporarily suspended. Barrick estimates that the production will be negatively impacted by around 145 thousand ounces of gold

- the other changes are marginal (for example, production cuts at Kalgoorlie or Porgera)

Interestingly, Barrick estimates that costs of production should remain unchanged, compared to the initial outlook.

Summarizing - I think that investors are overreacting and the current drop in share prices should be perceived as a nice speculative buying opportunity.

It looks like the Chinese pressure on hoarding some metals is dissipating. Look at copper:

source: Simple Digressions

The blue circles indicate periods of decreasing copper stocks at the Shanghai Futures Exchange (SFE). Note that during these periods the prices of copper go down or level off. As the chart shows, since middle March the Chinese have been cutting copper stocks with copper prices following this decrease.

Another example - silver:

source: Simple Digressions

Similarly to copper, since middle March the Chinese have been cutting silver stocks.

Finally, a different picture. This time it is about gold:

source: Simple Digressions

As the table shows, in February and March of 2017 the Chinese withdrew more gold than in the corresponding months of 2016. It looks like the Chinese still show strong demand for gold...

Yesterday I asked this question: What is going on with silver? The question is still open but let me show a probable solution.

This year (till April 19) the SLV silver holdings decreased by 15.0 million ounces. However, in the same period JP Morgan has added as many as 19.9 million ounces of silver to its COMEX holdings. Interestingly, all that silver added by JP Morgan belongs to the category called "Eligible" (held by JP Morgan on its own account). In other words, JP Morgan increased its silver holdings (belonging to JP Morgan and/or its customers only) by 19.9 million ounces.

Summarizing, it looks like this bank is withdrawing silver from SLV to increase its holdings at the COMEX.

As a result, the thesis that something strange is going on with silver is not correct. Quite opposite, it looks like the silver, similarly to gold, is heavily accumulated and the main entity doing it is JP Morgan.

source: Simple Digressions

As I discussed in my previous article, since the beginning of 2017 two large gold ETFs, GLD and IAU, have been generally accumulating gold. However, the largest silver ETF (SLV), has been doing the opposite:

source: Simple Digressions

The chart shows that every single month SLV reported an outflow of silver from its vaults. As a result, now there are 327.3 million ounces of silver at SLV vaults:

source: Simple Digressions

It means that since the beginning of the current bull phase in gold and silver (December 2015), the SLV holdings increased by a mere 3.0% (look at two red circles). To be honest, it is not an impressive result because, for example, GLD gold holdings went up by 29.6%!

So the question is - what is going on with silver?

Generally, gold ETFs should behave in the same way. For example, when one gold ETF accumulates gold, the other ETFs should do the same. However, sometimes it is not the case. Look at these two charts:

source: Simple Digressions

Note that in January the first gold ETF, IAU, accumulated 125.2 thousand ounces of gold (its total gold holdings increased by this amount of gold) but its much larger counterpart, GLD, decreased its holdings by 742.7 thousand ounces.

Over the next months both ETFS were doing the same:

- added gold in February and April (up-to-date)

- got rid off the gold in March

Interestingly, gold prices were going down or got stuck only in March, when both ETFs were selling gold...

JP Morgan, apart from being an active trader in precious metals futures, has been also aggressively accumulating gold and silver bullion this year. Look at the bank's precious metals holdings at the COMEX:

Interestingly, the bank has been particularly active in April, adding 380.8 thousand ounces of gold and 6.8 million ounces of silver to its COMEX vaults. It looks like this big speculator wants to hedge itself against something big...

Here is the chart of the week:

source: stockcharts.com

The chart shows the 30-year treasury bond price to S&P 500 ratio. The blue circles show cyclical lows of this ratio. Note that these lows correlate with the tops printed by the US stock market (red circles), represented by the S&P 500 index. The one-million dollar question is:

Is the US stock market topping now?

Today Richmont Mines (RIC) released its 1Q 2017 operating results. Let me show just three charts showing what is going with this miner.

The first chart shows cash costs of production at Richmont's flagship property, the Island Gold mine:

source: Simple Digressions

This year the company is going deeper into Island Gold (deeper than 400 metres below surface) and expects to increase production (to 87 - 93 thousand ounces vs. 83.3 thousand ounces in 2016) and cut cash costs of production (C$715 - C$765 per ounce). As the chart shows, the start into 2017 was really good and the cash cost of production was much lower than company's estimates (C$668 per ounce for 2017, on average).

However, the second mine, Beaufor, was kind of a problem to Richmont:

source: Simple Digressions

As the chart shows, between the beginning of 2015 and middle 2016 Beaufor's production was in a steep decline. This negative trend was stopped last year (red arrow) and the company expects Beaufor to deliver 23 - 27 thousand ounces of gold this year (19.6 thousand ounces in 2016).

What is more, the declining production was not the only problem at Beaufor because last year the mine was a high-cost gold producer:

source: Simple Digressions

According to the company, this year Beaufor should be producing gold at cash cost of C$1,265 - C$1,320 per ounce (C$1,444 in 2016) so the first quarter (red circle) shows that this forecast is not overly optimistic...

A few minutes ago Dundee Precious Metals (DPM.TO) announced its 1Q 2017 operating results. I guess Dundee is not a popular company among precious metals investors. Maybe it is so due to its quite complicated business model - the company, apart from a typical mining business, runs also a chemical plant in Namibia (the Tsumeb smelter).

Anyway, today's results are really good. Chelopech, the largest underground gold mine in Europe (located in Bulgaria), produced a substantial amount of gold:

source: Simple Digressions

Last year the company sold the Kapan mine so now it operates only Chelopech. However, Dundee is currently constructing its second mine, also located in Bulgaria. This time it will a medium-size open-pit mine called Krumovgrad - it should be online in late 2018.

The Tsumeb smelter delivered disappointing results but I would not bother about it. Due to some maintenance issues, this plant was not fully operational in 1Q 2017. Hence, lower amount of concentrates smelted (only 41.6 thousand tons) compared to, for example, 4Q 2016 (61.3 thousand tons). Since no additional stoppages are expected, the smelter should process 210 - 240 thousand tons of concentrate this year.

I think that Dundee shares are substantially undervalued against the company's peers (I mean precious metals miners). For example, they are trading at the EV/EBITDA ratio of 5.6 which is much lower than other mid-cap miners (around 8.0 - 9.0). It looks like a mining company involved in a capital intensive business (smelter) does not attract too many investors. Pity...

Today gold broke above its strong resistance at around $1,250 - $1,260 per ounce. The importance of this move has been additionally confirmed by other measures. Let me start from the golddollar index:

To remind my readers:

“The GolDollar Index was invented by Tom McClellan (of McClellan Financial) and is calculated by multiplying the price of gold by the U.S. Dollar Index. Its purpose is to cancel the effects of currency fluctuations on the price of gold. By comparing it with the spot gold index we can determine if there is inherent strength/weakness in the price of gold”

The blue circles are indicating today's breakout - note that the gold and the golddollar index did the same (they broke above their resistance marked in violet).

Another picture:

This time it is the inverted US dollar index chart. As a rule, gold and the inverted US dollar index go in tandem. If something different happens it may be an indication of the relative strength of gold or the inverted US dollar index. The chart shows that now gold is much stronger than the inverted US dollar index (note that gold is above its strong resistance but the inverted US dollar index is not).

Another graph:

Now it is gold against 10-year US treasury notes prices. I believe that 10-year US treasury notes are a good proxy for real interest rates (excluding inflation).

Lower real interest rates (and higher prices of US treasury notes) support higher prices of gold. So, as a rule, gold prices go in tandem with the prices of treasuries. However, as the chart shows, gold is once again stronger than treasuries - it did break above its strong resistance while the prices of treasuries did not.

Summarizing - gold is very strong now. Its price goes up without bothering about the US dollar. What is more, it is also stronger than US treasuries so it looks like we are ahead of another rally in gold...

Most recently Metanor Resources (MTO.V) completed a public placement with Eric Sprott acquiring a substantial stake in the company. Then the company announced it was going to close another private placement - this time addressed to Kirkland Lake (KL.TO) and Wexford Capital (a private investment company). If the last placement is successful, the company's shareholder base should look as follows:

source: Simple Digressions

It looks like Eric Sprott and Kirkland Lake, a mining company in which he holds a large stake, will jointly hold a 27.5% stake in Metanor.

Then, assuming that Wexford is going to cooperate with these two investors, they should jointly control 40.2% of the company. In other words, it seems that Metanor is going to become a part of Mr. Sprott's empire.

On that news the investors replicating Mr. Sprott movements rushed to buy Metanor shares (look at the red circle on the right):

source: stockcharts.com

However, the problem is that now Metanor shares are trading at the EV/EBITDA multiple of 11.2 (calculated on a fully diluted basis). In other words, Mr. Sprott made these shares quire expensive now...

The update to the 2017 Top Five Picks Portfolio has just been sent to you. Please, let me know if you have not received the report (technical problems happen). In such a case I will send it again.

Energold Drilling (EGD.V) is the last drilling company to publish its 2016 results.

To remind my readers - Energold is not a pure mineral drilling play. Apart from its Mineral Division, the company also runs two other business lines: energy drilling and manufacturing. And these latter businesses did not perform well in 2016. As a result, 2016 was not a turnaround year for the company. Look at the chart below:

source: Simple Digressions

As the chart shows, since 2013 the company was not able to deliver any cash from its operations. What is more, last year was one the worst in the company's history.

Does it mean that everything is bad at Energold? Not necessarily. Its Mineral Division reported quite promising results. Let me start from two operating measures - metres drilled and drilling prices:

source: Simple Digressions

Well, the green bars (representing the amount of metres drilled) look quite good - in 2016 the company drilled more metres than in 2015. However, the red chart line showing drilling prices looks like an ECG (electrocardiogram) chart. Surely, the company has some problems with its pricing policy...

Further, mineral drilling margins improved in 2016. The left panel of the chart below shows annual gross margins (defined as revenue less direct costs, then divided by revenue). Note an uptick in a gross margin in 2016, compared to 2015.

The right panel of the chart shows margins reported in 2016 on a-per-quarter basis:

source: Simple Digressions

On the other hand, last year the Energy Division reported much lower gross margin than in 2015:

source: Simple Digressions

I would summarize this discussion as follows:

Although the Mineral Division reported promising results (in 4Q 2016 it even booked a net profit of around C$1M) , two other business lines (energy and manufacturing) performed badly in 2016.

The result is here:

source: Simple Digressions

As the chart shows, since the beginning of 2016 Energold shares have been the worst performing shares amongst their peers.

Yesterday Endeavour Silver announced the results of the Pre-Feasibility Study on Terronera. Well, the problem is that the detailed study will be available within 45 days from the announcement. However, on the first sight the project is not impressive (at least for me).

Firstly, net present value of the project (I assume the company means the after-tax NPV) is $78.1M (base case scenario):

Recalculating this figure on a-per-share basis it means that Terronera should increase the company's value by $0.61 a share so investors reacted on the news and started aggressively buying Endeavour shares. At the time of writing this post the shares are up by $0.46 per share since the announcement so...it looks like the initial impulse is going to dissipate quickly. But you know, markets are crazy so...who knows.

Other measures, IRR and payback period, are not impressive as well (especially the payback period of 4.3 years is quite extended).

Another point - the total cost of production (mining, processing, administration and royalties) is estimated at $72 per ton of ore. Well, it is a very low cost. For example, the lowest cost mine in the company's portfolio, Bolanitos, has been producing its metals at the average costs of production (2012 - 2016) of $75.4 per ton of ore.

Further, it looks like the company omitted the external dilution factor, which, for the cut and fill mining method stands at 15%. Here is an excerpt from the company's reserves estimate (point 7):

"Dilution factors for mineral reserve estimate calculations averaged 29% for Guanaceví, 21% for Bolañitos, and 30% for El Cubo. Dilution factors are calculated based on internal stope dilution calculations and external dilution factors of 15% for cut and fill mining and 30% for long hole mining"

If I am correct, the total life of mine production should stand at 19.2M ounces of silver (instead of 22.6M) and 157 thousand ounces of gold (instead of 185 thousand). Expect my additional comments when the PEA is available.

In March the demand for silver eased a little bit:

in millions of silver ounces:

The largest private holder of silver bullion, the iShares Silver Trust (SLV), reported an outflow of silver from its vaults amounting to 1.6 million ounces.

Interestingly, the Shanghai Futures Exchange, which in 2015 started aggressive accumulation of silver, decreased its stakes in March (by 4.3 million ounces).

On the other hand, JP Morgan was still accumulating silver in March and added 0.7 million ounces.

Summarizing - the physical demand for silver retreated in March.

Similarly to the physical market, the paper demand did the same. Big speculators cut their net long positions in silver futures by 4.7 thousand contracts (attributable to 23.5 million ounces of silver). However, the net long position held by these traders still stands at a very elevated level (the green circle):

What now? Normally I would say that silver prices are poised to correct but the problem is that the gold market is in a totally different situation. Here the speculators are rather pessimistic about gold prices and it is the gold market that is a leading indicator in the precious metals sector.